COMPARE

FAMILY INCOME

BENEFIT POLICIES

THIS COMPARISON SERVICE

IS BROUGHT TO YOU BY

LifeSEARCH

In 4 out of the last 5 years, LifeSearch has been voted the Best Protection Adviser at the annual Money Marketing Financial Services Awards.

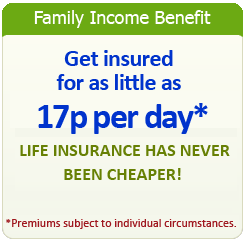

Family Income

Benefit Insurance.

WHAT DOES IT DO?

Family Income Benefit Insurance pays a tax free income to you or your family if you fell terminally ill or died. The income finishes when your policy comes to the end of its term. Regulation: Click here to see our Disclosure Document

Get Quotes. Complete your details now.

Regulation: For Disclosure Document, click here.

![]() Discover the best deal

Discover the best deal

![]() Family Income Benefit Plan's compared

Family Income Benefit Plan's compared

![]() Expert Advice ensures you make a wise choice.

Expert Advice ensures you make a wise choice.

![]() Our award-winning brokers find you the cheapest, most suitable critical illness cover on the market.

Our award-winning brokers find you the cheapest, most suitable critical illness cover on the market.

![]() Get a free, no-obligation quote now

Get a free, no-obligation quote now

Compare policies and choose wisely.

When you're buying Family Income Benefit it's important to compare prices and get advice. That's why Brokers Online has appointed LifeSearch, the 2008 winner of the Best Protection Adviser awarded by Money Marketing. This is the fourth time in the last five years that LifeSearch has won this prestigeous Award.

LifeSearch will automatically contact the Insurance companies to compare prices and find the best deal. Then they'll phone you to present the comparisons and provide valuable advice. You can then make an informed and wise choice.

Why do I need Family Income Benefit Insurance?

If you are the main or only income provider in the family then you know how difficult it will be for those you leave behind to keep up with all the regular expenses. Family Income Benefit Insurance helps replace the income that has been lost, pay bills such as food and necessities, and your monthly financial obligations such as the mortgage or rent, credit card and loan payments.

The income you receive will depend entirely on the amount of cover you choose when you take out the insurance policy. The Adviser from LifeSearch will help you sort everything out.

Check out the answers to the Frequently Asked Questions about Family Income Benefit

Click here if you wish to see our Protection Insurance Disclosure Document

What should I consider when taking out a Family Income Benefit Insurance Policy?

Ask yourself the following questions before arranging your Family Income Benefit Insurance:

1. How much monthly tax-free income will the family require if you were to die.

2. How many years do you want the policy to cover? Please note that an income is only paid to the dependents up to the expiry date of the policy. At the end of the specified period all payments will cease.

3. Do you require the payments to be index linked to rise at the same rate as inflation or would a fixed payment suffice? An index-linked policy will cost you more than a fixed policy.

4. Does the policy need to cover just your death or does it also need to provide cover in the event of your partners' death? Policies for the latter are called "joint" policies. Alternatively, you could each take out your own policy. Your Adviser will advise you.

Did you know?

- 1 in 3 people develop cancer at some point in their lifetime, 1 in 4 die from cancer

- 1 in 5 male deaths occur between the ages of 20 and 65

- There are an estimated 2.68 million people living with Coronary Heart Disease in the UK

- 75,000 people suffer a heart attack, stroke or cancer every year

- 33% of people have no insurance to pay off their mortgage if they die

3 Top tips for buyers of Family Income Benefit Insurance.

Tip 1

A Guaranteed policy could eventually work out cheaper than a Reviewable Policy.

Reviewable Family Income Benefit Insurance policies have the lowest premiums on day one but Guaranteed policies work out much cheaper over the medium/long term. This is because as the years go by, Reviewable premiums increase whereas Guaranteed policies have their prices fixed and guaranteed forever (there’s more information about this on our FAQ Menu).

Tip 2

Adding health cover to your life insurance policy? Make sure you understand the difference between Terminal Illness and Critical Illness cover.

People frequently confuse Terminal Illness cover with Critical Illness cover - but there’s a world of difference between the two. Make sure you appreciate the difference.

A Terminal Illness is any illness from which you are expected to die within 12 months from diagnosis (as certified by a Doctor). You cannot buy a stand-alone Terminal Illness policy – terminal illness cover is always included free within Critical Illness policies and most good life policies automatically include Terminal Illness cover at no extra cost.

A Critical Illness policy pays out if you are diagnosed with a much wider range of qualifying chronic illnesses but remember, with many illnessess, you could survive for a very long time. For example: certain cancers, heart disease, multiple sclerosis, loss of speech/sight/hearing, onset of Parkinsons or Alzheimers disease before the age of 65, coma, various tumours, stroke, third degree burns etc. Please be aware that the insured illnesses do vary between insurance companies and Critical Illness cover will always cost you extra.

Tip 3

Now could be a good time to add Critical Illness to your new Family Income Benefit Insurance policy.

There are good reasons why this might make sense:

- If you are going to need Critical Illness Insurance in the future, then consider including Critical Illness now within your Family Income Benefit Insurance policy. It could work out significantly cheaper than buying two separate policies.

- You should be able to buy a combined family Income Benefit and Critical Illness Insurance policy with a guaranteed fixed premium. This is a big advantage as many insurance companies will not offer a guaranteed premium if you buy Critical Illness Insurance alone. (Read Tip 1 for more details).

- Ensure that you have insurance to pay off your outstanding mortgage.

Did you know that around 30% of people don’t have insurance to pay off their outstanding mortgage if they died or became terminally ill? Are you one of these people? If so, get a quote for life insurance to cover your mortgage – you can combine it with your Family Income Benefit Insurance and it will be very reasonable.

Family Income Benefit, Family Income Insurance from Brokers Online